On January 10, 2023, the Contra Costa Board of Supervisors passed an ordinance that allows for the sale and delivery of non-flavored cannabis vaping products in unincorporated areas. This ordinance was proposed in order to help homebound seniors who rely on cannabis vaping products for medical reasons. Since flavored tobacco vape product sales were banned in 2019, these vulnerable populations have been disproportionately affected. The Board came to the decision that adults of all ages in need of medicinal cannabis should be able to access it without undue hardship or dangers. This ordinance changed regulations regarding vape products to make it easier for adults - particularly seniors - to receive the medication they require from a dispensary with the assurance that what they are getting is safe and effective. The key factor here is safety - no longer will adults have to worry about them unknowingly taking something that could put their health at risk. It’s a step in the right direction for improved access and peace of mind across the board. According to a resident of Rossmoor retirement community, Renee Lee, many medicinal marijuana users prefer to vape rather than to smoke or consume the product through other ways. She operates an organization that is dedicated to helping seniors access cannabis in a legal and safe manner. Groups such as Americans for Safe Access have advocated for greater access to marijuana vaping products by pointing out that banning them only creates an illicit black market. They argue that seniors—who are more likely to rely on cannabis vaping products because they are easy to use and provide quick relief from pain or anxiety—are particularly affected by this ban. Making these products accessible through dispensaries could help meet their needs without forcing them into potentially dangerous situations. “The black market is awash with high-potency products, products that are contaminated,” says Sarah Armstrong, an advocate with the organization. She further states that laws or regulations which push people to turn to the black market only create problems for patients, law enforcement officials, and those in the community who are affected by increased criminal activities within their neighborhoods. Allowing the sale of marijuana vaping products can produce several positive outcomes, such as safe and legal access, as well as decreased prices due to competition in the marketplace. However, the risks of youth cannabis vaping continue to be a major concern for the county’s officials. Additionally, there are concerns over whether vaping can cause harm to the body over the long term. For these reasons, the board continues to ban tobacco and tobacco flavored vaping products. The Contra Costa Board of Supervisors has taken a step forward in ensuring that homebound seniors have access to the medications they need without having to worry about going outside or purchasing from an illegal source. While there are potential risks associated with allowing non-flavored cannabis vaping products, the benefits far outweigh any potential negatives for individuals who require cannabis for medical reasons.

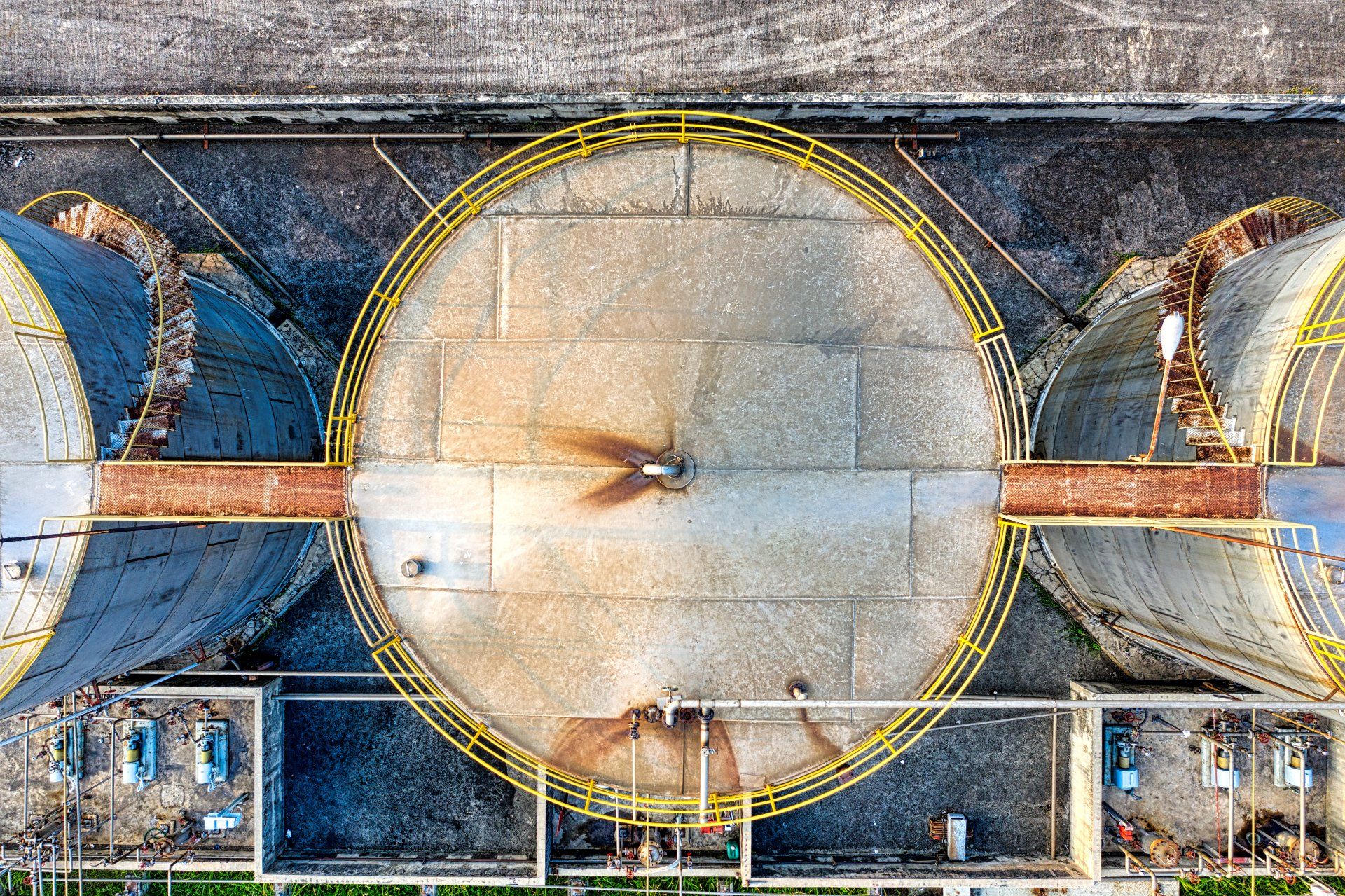

Blog Introduction: On the night of Thanksgiving and in the early hours of the following day, the Martinez Refining Company released a large amount of “spent catalyst” into the air in Contra Costa County, California. The release has raised many questions about the potential health effects of this dust and the actions being taken by local health departments to investigate it. The Martinez Refining Company initially reported that they had released a 20-ton dust cloud containing non-toxic particulate matter into the atmosphere. According to their report, their own tests showed that the dust did not contain any harmful contaminants and should not cause the community any alarm. As a gesture of good will, the company offered free car wash vouchers to residents. In response to these initial reports, Contra Costa County's Public Health Department (CCCPHD) recommended an independent risk assessment into the incident. The CCCPHD also requested additional information from Martinez Refining Company about their activities leading up to and following the dust release. Inhaling large amounts of dust can cause respiratory symptoms such as coughing and difficulty breathing. Additionally, prolonged exposure to some metals, like lead or nickel, can lead to more serious health issues such as kidney damage or reproductive problems. It is important to note that there are no known immediate health effects from this particular incident; however, further investigation is needed in order to determine if there could be any long-term health implications associated with it. According to officials, there were high levels of aluminum and various other metals found within the samples of the dust that had been collected. As such, there is a risk of respiratory issues or long term health concerns to any individuals who may have been exposed to it for a prolonged period of time. John Gioia, a Board of Supervisors Chair, stated that “by failing to notify the County in a timely manner, the refinery delayed an emergency response that could have reduced harm to the surrounding community.” The Contra Costa County Health Department only found out about the release from media accounts two days after it took place. The news put authorities in a difficult position, as they were unable to advocate for the health and safety of local citizens on short notice. Luckily, the community groups in the region stepped up with action plans and began working together to limit the environmental impact before any significant damage occurred. The recent refinery release in Contra Costa County highlights how important it is for us to monitor local industrial activities and take action when necessary in order to protect public health. It is encouraging that local health departments are taking steps to investigate this incident in order to better understand its potential impacts on our environment and our community’s overall health and safety. We must remain vigilant in monitoring any potential risks posed by industrial activities so that we can better inform our decision making moving forward.

As Marvin Saravia stepped out of Home Depot, he was filled with a sense of dread. In just a few short minutes, his world had been completely turned upside down as all of the tools necessary for his handyman business were stolen from his truck. A single thought ran through his mind - “I’m just going to give up.” Threatened by a bleak future without work, Saravia fell into despair. That's when he stumbled across Monument Impact, the Contra Costa County-based non-profit organization that was able to cut him a check for $1500 to replace his tools in order to get him back on track. With their help, Marvin Saravia has been able to reestablish himself in his field as a handyman with bright prospects for the future. Monument Impact is a nonprofit organization that primarily provides day labor opportunities for immigrants, refugees, and other low-income people. They also provide business education classes and one-on-one help with licensing requirements. Most recently, Monument Impact has been very active in advocating for rent control and affordable housing policies. As part of their efforts to support low-income residents in the area, they’ve launched a Share the Spirit campaign to raise money for their cause. The organization started out as a small program over two decades ago that connected immigrants and refugees with day labor opportunities. By 2012, they had merged with another organization called Monument Community Partnership to become one unified nonprofit focused on helping the underserved immigrant population of the East Bay. Since then, their mission has only grown more expansive and ambitious - from providing job training and employment services to advocating for social justice policies such as rent control and affordable housing initiatives designed to protect low-income residents from exploitation by landlords or real estate developers. Monument Impact offers a variety of services designed to assist low-income people in the East Bay area. Their day labor program connects immigrants, refugees, and other low-income people with short-term jobs that provide them with an income while they search for more long-term employment options. In addition to this program, they also offer business education classes as well as one-on-one help with licensing requirements so that small businesses can get off the ground quickly. Finally, they are actively engaged in advocacy work aimed at promoting rent control and affordable housing policies that will benefit those same communities who need it most right now. Each year, these services impact over 10,000 people throughout Northern California. The Share the Spirit Campaign is just one way that you can show your support for Monument Impact’s mission of helping underserved populations find economic stability through employment opportunities and access to resources such as affordable housing policies. By donating to this worthy cause today, you can help make sure that vulnerable communities have access to critical resources like job training programs so that everyone can get ahead financially regardless of their circumstances or background.

Healthy eating and access to nutritious food can be life changing. That’s why Fresh Approach, a nonprofit dedicated to increasing access to local, affordable, healthy foods in the Bay Area has been working hard since 2016 to bring fresh produce directly to people’s doorsteps. Since the start of the COVID-19 pandemic and with increasing inflation concerns, there has been an increase in demand for their services. Through its mobile farmers' market truck, Fresh Approach has had a positive impact on one Richmond resident's life. Marsha Quick shared that “the mobile farmers’ market truck has made it easier for me to get fresh fruits and vegetables that I need instead of having to go grocery store hopping." Let’s take a look at some of the benefits of healthy eating and food access, as well as Kaiser Permanente's role in supporting healthy eating habits. Eating nutritiously can have many long-term health benefits such as improved physical health and increased energy levels. It can help to prevent various diseases while allowing families to enjoy more delicious and diverse meals. Quality of life is also enhanced when individuals have better access to healthy foods that they can afford because they are more likely to stick with their diet plan and make healthier choices. By providing easy and affordable access to fresh produce, such as locally grown and seasonal fruits and vegetables, Fresh Approach encourages customers to explore more nutritious food options, and expand their repertoire of recipes. Kaiser Permanente Northern California Vice President Sharolyn Reed says the company has taken on a commitment to improving food security by supporting initiatives such as Fresh Approach's mobile farmers' market truck, which provides convenient access points for purchasing fresh produce throughout the Bay Area. The organization has taken steps to tackle issues related to food insecurity in Bay Area communities by providing nutrition education programs, cooking classes, food pantries, community gardens, farm stands, mobile markets, and other initiatives that increase healthy food access for underserved populations. Fresh Approach is making great strides in ensuring healthy food access for underserved populations throughout the Bay Area. Their focus on providing nutritious options like organic fruits and vegetables have been life changing for many Richmond residents, who are now able to purchase produce without having to venture far from home or straining their grocery budgets. With support from organizations like Kaiser Permanente, who understand the importance of providing consistent access points for purchasing fresh produce, Fresh Approach will continue its mission of helping Bay Area residents gain easy access to nutritious foods through their mobile farmers' market truck. We encourage everyone reading this blog post to take advantage of these opportunities when available so they can enjoy all the benefits associated with maintaining a balanced diet! The Fresh Approach truck can be found at the Richmond Public Library every Wednesday between 10 to 11 am. Afterwards, it will move to the San Pablo Senior Center where it will stay from 11:45 am to 12:45 pm. Its last stop will be at the Richmond Parkway YMCA from 1:45 to 2:45 pm.

Electronic Benefit Transfer (EBT) cards are debit cards that allow those receiving public assistance to purchase food and other necessities. Unfortunately, some people try to take advantage of this system by cloning these cards in order to access funds illegally. This is known as EBT card fraud. Those who participate and perpetrate these card fraud schemes victimize low income families within the community, who rely on EBT cards to make ends meet. As a result, the most vulnerable individuals have had to bear the burden of these criminal activities. Many were forced to forego meals or go into further debt in order to buy food and other essentials. Fortunately, California is one of the few states that will pay back fraud claims, but there may be little recourse for victims in other states. Over the past 12 months, California has reported a loss of close to $24 million due to scams. By July of 2022, the state paid out almost $3.8 million to those who had been victimized by EBT fraud. This is an alarming increase of over 4000% from 2021. Recently, two men – Florin Tanasa, 27, and Adam Nilson, 30 – were arrested on suspicion of participating in an EBT card fraud scheme. The men were accused of cloning EBT cards through the use of card skimming devices or other illicit means. In this particular case, police officers investigating a suspicious vehicle found 50 cloned EBT cards, thousands of dollars in cash, and card skimming equipment inside the vehicle. It appears that the perpetrators had been using these cloned cards to attempt to withdraw funds at ATM machines throughout California. Police officers believe that the investigation may uncover potential ties to other counties and cities within California where similar activity has taken place. A court motion was filed by deputy district attorney Dana Filkowski, who argued the suspects were a flight risk and a threat to public safety. Additionally, any funds the suspects had access to would likely be proceeds from their crime. As such, bail was set at $1 million each by the presiding Judge Nancy Davis Stark. There are a number of protective measures individuals can take when using ATMs or point-of-sale machines in order to avoid financial fraud and keep their personal information safe from being compromised. These include regularly monitoring bank accounts for unusual activity, using secure machines when possible, shielding PIN entry from view, being wary of requesting help from strangers, not leaving debit or credit cards unattended, and not disclosing personal information to unknown sources. According to experts, scammers are particularly crafty when utilizing EBT, since they usually opt for taking out only small amounts of money at a time in order to avoid detection. To protect your finances, it is important to monitor transactions closely and take action immediately if any suspicious activity occurs. By staying alert and informed, those who rely on EBT can ensure that their much needed benefits remain safely in their accounts.

Homeownership is becoming out of reach for many people in Contra Costa County and throughout the United States. It appears as though affordability of single-family homes and condos is becoming increasingly difficult in counties across the country, according to Attom's recent home affordability report revealed this week. During the third quarter of 2022, 99 percent of the 581 counties that were studied showed home prices outpacing wage growth, a statistic which has increased sharply. This was an upsurge from 69 percent during the same period in 2021; suggesting that more and more people are being priced out of purchasing their own property. The report identifies affordability indicators for people based on average wages, taking into account mortgage payments, costs of insurance and property taxes, as well as their ability to cover living expenses with debt-to-income ratios not exceeding 28 percent. Comparing these figures to those from the Labor Statistics Bureau provides a more detailed analysis of the current housing market. The Attom report reveals that homeownership is still out of reach for many Contra Costa County residents as well as most of the rest of the country. With mortgage rates at 3 to 6 percent for a 30-year loan, and median home prices up 10 percent while wages only grew 6 percent, it is not surprising that home sales have been on the decline. However, the demand continues to be high while supply remains low, driving up prices even further in many areas. “Many prospective homebuyers simply can’t afford the home they hoped to buy, and in many cases no longer qualify for the mortgage they’d need,” says Attom executive vice president of market intelligence Rick Sharga. So what can be done about this pressing issue? For starters, there are government programs and incentives available for first-time homebuyers that can help reduce some of the costs associated with buying property; however, these programs may not be enough for those living in highly competitive housing markets like San Francisco or Oakland. Another possible solution is investing more resources into wage growth initiatives so that people earn enough money to afford higher priced homes in their desired locations without having to stretch themselves too thin financially. Additionally, if cities invest in building more affordable housing options then more people will have access to lower cost homes near their places of work or school, which could save them time and money on transportation costs as well as provide them with more stability overall. The U.S Home Affordability Report paints an unflattering picture of current housing conditions across America; however, there are solutions available that could help more people achieve homeownership if they are given access to affordable homes within their budget range and/or receive assistance through government programs or wage growth initiatives. Hopefully with increased attention on this issue we can start seeing positive changes soon!

Antioch and the surrounding areas have long been known as a great source of creative energy. The combined talents of various art and film communities offer a unique backdrop for filmmakers, yet oftentimes their productions are met with little recognition. Unfortunately, due to a lack of resources, many independent films go unnoticed by those not within their immediate circle, leaving them without the opportunity to reach an audience and shine in the creative spotlight. If more attention was given to independent film productions in this area, it could lead to increased recognition, both nationally and internationally – a real bonus for Antioch's art scene. Since its inception in 2018, The Dark Fest has become one of the most popular events of its kind. Founded by Jason D. Morris, a graduate of Antioch High School and attendee of the Academy of Art University in San Francisco, it quickly gained its reputation as an event to bring together fans from multiple genres to celebrate all that is dark and mystical. With an incredible line-up of artists each year, entertainment provided throughout the night, and activities for everyone, The Dark Fest is undoubtedly the place to be for both horror enthusiasts and casual attendees alike. From stunning sets to unforgettable acts, The Dark Fest continues to impress its audience with something new every year. An award winning filmmaker, Morris has shown his films at major events like Comic-Con and the Sundance Film Festival in the past. Morris’ vision is to create a space where up and coming filmmakers can have their work seen by others in the industry without having to go through traditional venues like Hollywood studios or big budget productions. After his own experience on the film festival circuit, Morris realized how inaccessible it can be for the average filmmaker to have their work seen. Festivals can be expensive to attend, and often take place in far away destinations. Renting out a theater can also be cost prohibitive for many. He wanted to provide local filmmakers with a more inexpensive way to screen their films and share their work. The event will take place at the El Campanil Theatre on September 17th starting at 5:30 pm. Ticket prices range from $8 for youths and seniors to $10 for adults. There will also be concessions and musical entertainment available to start off the night! The event is rated R, which means that all attendees under the age of 17 will not be admitted unless accompanied by an adult. If you are interested in attending this year’s event, tickets can be purchased online (subject to availability). You can find out more information about ticket prices and packages by visiting www.thedarkfest.com/tickets/. Guests are encouraged to arrive early so they don’t miss out on any of the exciting films being shown. If you’re an independent filmmaker or just someone who loves darkly themed movies, then make sure to check out The Dark Fest this September! It is sure to be a night filled with amazing films from local filmmakers that will leave guests feeling inspired and entertained.

The California megadrought is the worst in over 1000 years and, despite the high water costs facing Californians, an alarming number still have not replaced their lawns or considered low-water solutions. While the state is facing the dire impacts of an unprecedented water crisis, it is concerning to think that many have yet to make more responsible landscaping choices to help conserve water. Not only would replacing lawns with drought-resistant vegetation cut down on unnecessary water consumption, it could also save homeowners money in the long run. It's time for Californians to confront the challenge of this dry era and recognize that small individual changes can make a big collective difference. From Shawn Maestretti’s “lasagna mulching” process to Flora Grubb’s suggestion of removing grass entirely, we’ll explore various ways to beat the drought and transform your outdoor space. Maestretti is an avid gardener and landscaper who has developed a process called “lasagna mulching." The process involves covering existing turf with cardboard and then adding layers of organic material like straw or wood chips on top. This helps build healthy soil without completely ripping out the turf. The benefits of this approach include reduced water consumption and improved nutrient content in the soil. Gardening expert Flora Grubb, however, suggests removing the lawn entirely in favor of other ground cover plants that require less water than grass. In addition to reducing water consumption, replacing lawns with drought-tolerant plants can also help reduce air pollution from gas-powered mowers. If you're looking for a way to spruce up your outdoor space and ease the burden on water utilities, switching out your lawn for more eco-friendly alternatives is an excellent option. Major landscaping overhauls can be costly, however many water districts are offering financial support in the form of rebates to homeowners who replace their grass with native vegetation or drought-resistant plants. Through the adoption of these more climate-associated plantings, not only can we improve our own immediate environment aesthetically, but also make supportive contributions towards protecting overall biodiversity while saving natural resources on a larger scale. Contrary to popular belief, low-water gardens don't have to be just cactuses and stones—they can be lush and beautiful too! Gardeners who have made the switch report having flowers that bloom year-round as well as more wildlife like bees, birds, squirrels, and lizards visiting their gardens. Moreover, there are plenty of different styles of low-water gardens including Mediterranean gardens, cottage gardens, meadow gardens, desert gardens, etc., so you're sure to find something that fits your aesthetic preferences. California's megadrought is no joke—it affects everyone living in the state regardless of income or social status. Luckily, there are several solutions available if you're looking to replace your lawn with a low-water garden. From Shawn Maestretti's "lasagna mulching" process to Flora Grubb's suggestion of removing grass entirely (and everything in between), we've explored how you can beat the drought while still having a beautiful outdoor space that will attract wildlife all year round! So what are you waiting for? Get started today!